Preauthorization

Hold a specific amount on the customer's card without charging it immediately. This guarantees available funds and allows the amount to be adjusted or captured later—ideal for scenarios like hotels, rentals, or variable-cost services.

How Preauthorization works

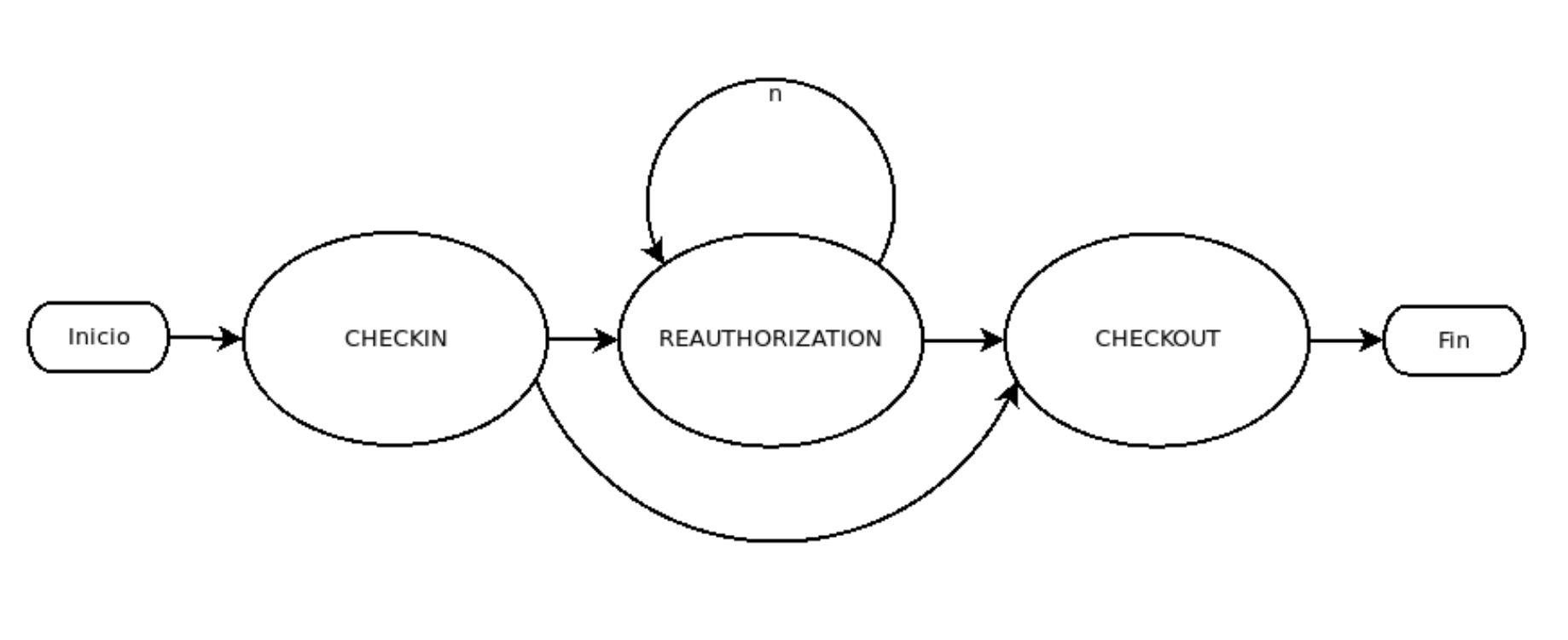

The preauthorization process consists of three key stages: Check-in, Reauthorization, and Checkout. Each stage plays a specific role in managing the reserved funds on the customer's card, ensuring flexibility and security throughout the transaction.

- Check-in (Initial authorization): A hold is placed on the customer’s card for a specific amount. No charge is made at this stage.

- Reauthorization (Optional adjustment):: The held amount can be increased if the service value changes.

- Checkout (Capture or Release):: The hold is either captured (charged) or released, it finalizes the transaction.

Benefits of Preauthorization

Flexibility: Merchants can adjust the held amount as needed, accommodating changes in the service or transaction value.

Security: By holding funds upfront, merchants reduce the risk of payment failures or insufficient funds at the time of final payment.

Customer Experience: Customers are not charged immediately, allowing for a smoother transaction process, especially in cases where the final cost is uncertain.

Key Considerations

- Preauthorization is not suitable for all payment scenarios. For example, mixed payments or dispersion payments are not allowed.

- The currency and payment reference established during the initial check-in must remain consistent throughout the process.

- Failed operations due to external factors with a rejection status (such as system outages) do not affect the flow, and these steps can be retried.

Transaction structure

Although the structure is not directly relevant for integration, it is useful for understanding how the system internally represents pre-authorization transactions:

- Check-in, Reauthorization, and Checkout are transaction types.

- All three are linked to a main transaction of type Pre-authorization, which acts as a summary of the flow. This main transaction is automatically created when a Check-in is performed.

- It starts in a pending state and reflects the held amount.

- Each Reauthorization updates the held amount in the main transaction.

- A Checkout concludes the flow by marking the Pre-authorization transaction as approved and assigning the final amount.

This hierarchical structure allows merchants to fully track the flow of a pre-authorized payment.

Integrate preauthorization flow in your application

Preauthorizations can be seamlessly integrated into your application using two methods:

- Web Checkout provides a fully built-in user interface, making it easy to implement without extensive development effort. It is ideal for merchants who prefer a ready-to-use solution.

- Gateway offers a robust API for greater flexibility and customization, allowing merchants to tailor the integration to their specific use cases.

Both options ensure secure and efficient handling of preauthorizations, enabling you to choose the approach that best fits your business needs. To continue, please select the integration method that suits your needs:

- Integrate preauthorization payments with Web Checkout

- Integrate preauthorization payments with Gateway API

Check-in

Check-in is the initial step where a hold is placed on the customer’s card for a specific amount. This does not immediately charge the card but ensures the funds are available.

- The

actionmust becheckin. - The payment reference and currency are established during this step and reused in later operations (Reauthorization, Checkout).

- Mixed payments and dispersion (scatter) payments are not supported.

- The parent transaction remains in state pending until a Checkout is performed.

- The

preAuthorizationnode in the response stores critical data for later operations.

Reauthorization

Reauthorization allows the merchant to update the amount of the original hold before the final capture.

Not available in Puerto Rico.

For Transerver Retail, reauthorizations are limited exclusively to incremental adjustments to the amount previously authorized during the CHECKIN process or a prior REAUTHORIZATION.

This means it is not possible to reduce the authorized amount. If a reauthorization is attempted with an amount equal to or lower than the previously authorized value, the transaction will fail; in cases where a lower amount needs to be processed, the CHECKOUT process must be used instead.

- Multiple reauthorizations are allowed before checkout.

- The payment reference and currency are reused from the original Check-in.

- You must provide

internalReferenceandauthorizationmatching those in thepreAuthorizationnode from Check-in.

Checkout

Checkout is the final step where the merchant decides to either capture the held amount or release it.

- A Check-in must be completed first.

- A Reauthorization is not mandatory; you may proceed directly from Check-in.

- If the amount is

0, the hold is canceled and funds are released. - The payment reference and currency must match the original Check-in.

- Provide

internalReferenceandauthorizationfrom thepreAuthorizationnode. - On success, the

preAuthorizationnode is updated with new values forstatus,authorization, andreceipt, which are required for Reverse operations.