Introduction

3DS Evertec is the service from Evertec, Inc that enables acquirers to enroll merchants and route transactions through the EMV® 3D-Secure protocol. This service allows the user authentication process to be performed, thereby reducing merchants’ exposure to chargebacks. Using 3DS Evertec can increase security and efficiency in online transactions.

This documentation is designed to provide a comprehensive understanding of the 3DS Server (3DSS) component and how it can be effectively integrated into your platform. It consists of two main sections:

-

General Description: In this section, you will find an overview of the 3DS Server component, including its purpose, how it works, and the benefits it brings to the security of online transactions.

-

API: Here you will find all the technical information necessary for integrating the 3DS Server into your systems. This section is intended for developers and technical teams who want to quickly and securely implement the functionalities.

Supported Networks

3DSS Evertec is certified under EMV® 3DS 2.2.0 and EMV® 3DS 2.3.1 with the following programs:

Note: "Supported" means the network is fully integrated and functional. "In progress" indicates that integration is underway and expected to be available soon. "Unsupported" indicates that integration is not available.

We are currently in the process of obtaining certification for EMV® 3DS 2.3.1 with Visa. We are awaiting approval from the brand to proceed with the process.

About this Document

This document initially explains what the EMV® 3D-Secure protocol is and provides the basic information needed to understand the authentication process in the 3DS Server.

The API section defines the service endpoints, required fields and their specifications, along with examples of requests and responses. It also includes test card data and their expected behaviors.

This document also covers terms and definitions, error codes, HTTP status codes, and the possible outcomes of an authentication. A Frequently Asked Questions (FAQ) section is included to resolve common issues and questions.

-

Authentication Result: Once the authentication process is completed, the ACS sends a message with the result back to the acquirer's 3DS server. The result may indicate a successful authentication, an attempted authentication, or a failed authentication.

-

Transaction Completion: The merchant receives the authentication result and proceeds to complete the transaction. If authentication was successful, the merchant requests payment authorization from the issuing bank. If authorization is approved, the transaction is completed and payment is made.

-

Confirmation: Finally, the cardholder receives confirmation of the transaction, either through the merchant's website or app, or via notification or email.

This process helps protect against unauthorized use of credit cards online by providing an additional layer of security and authentication.

Authentication Flows

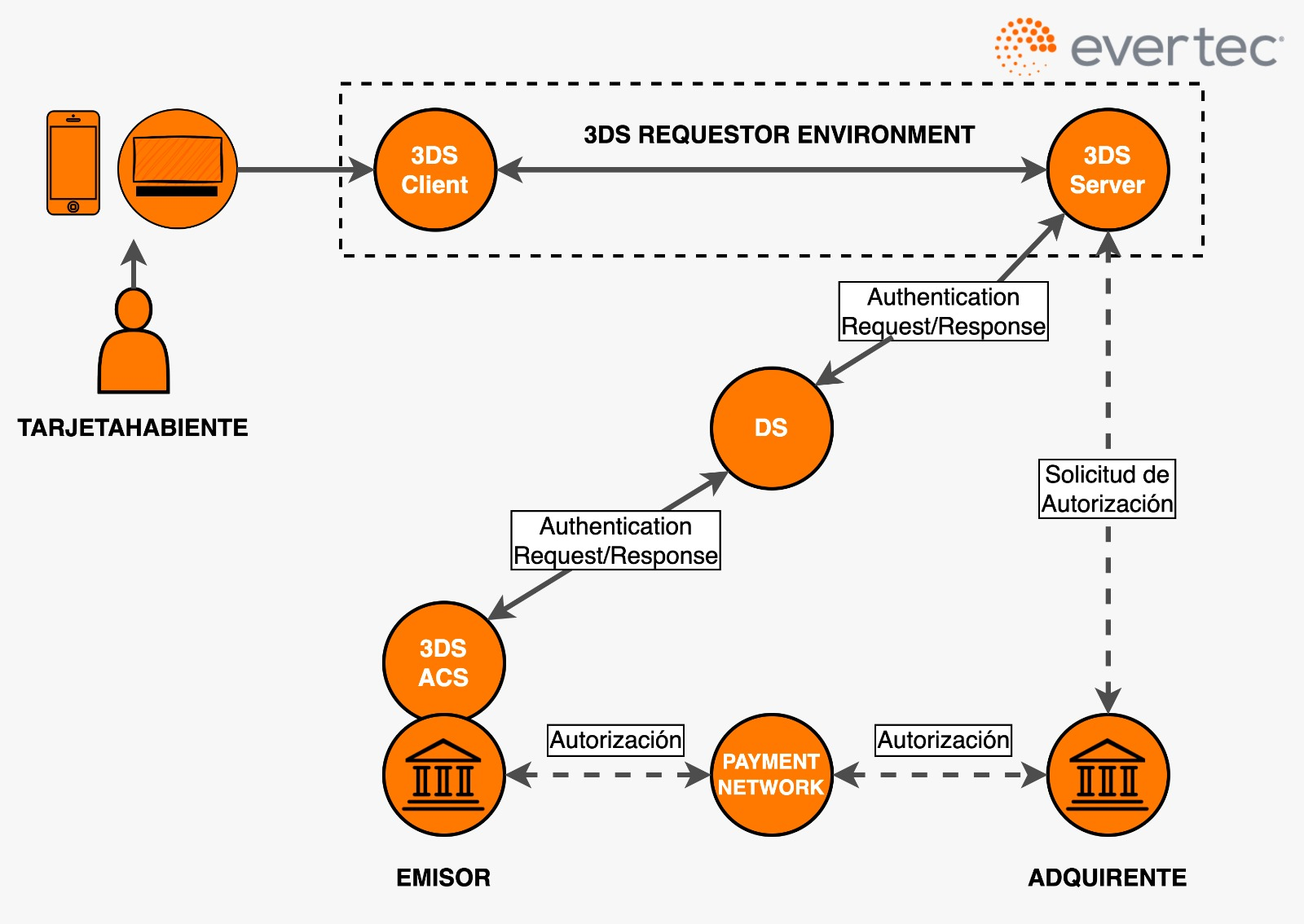

Frictionless Flow

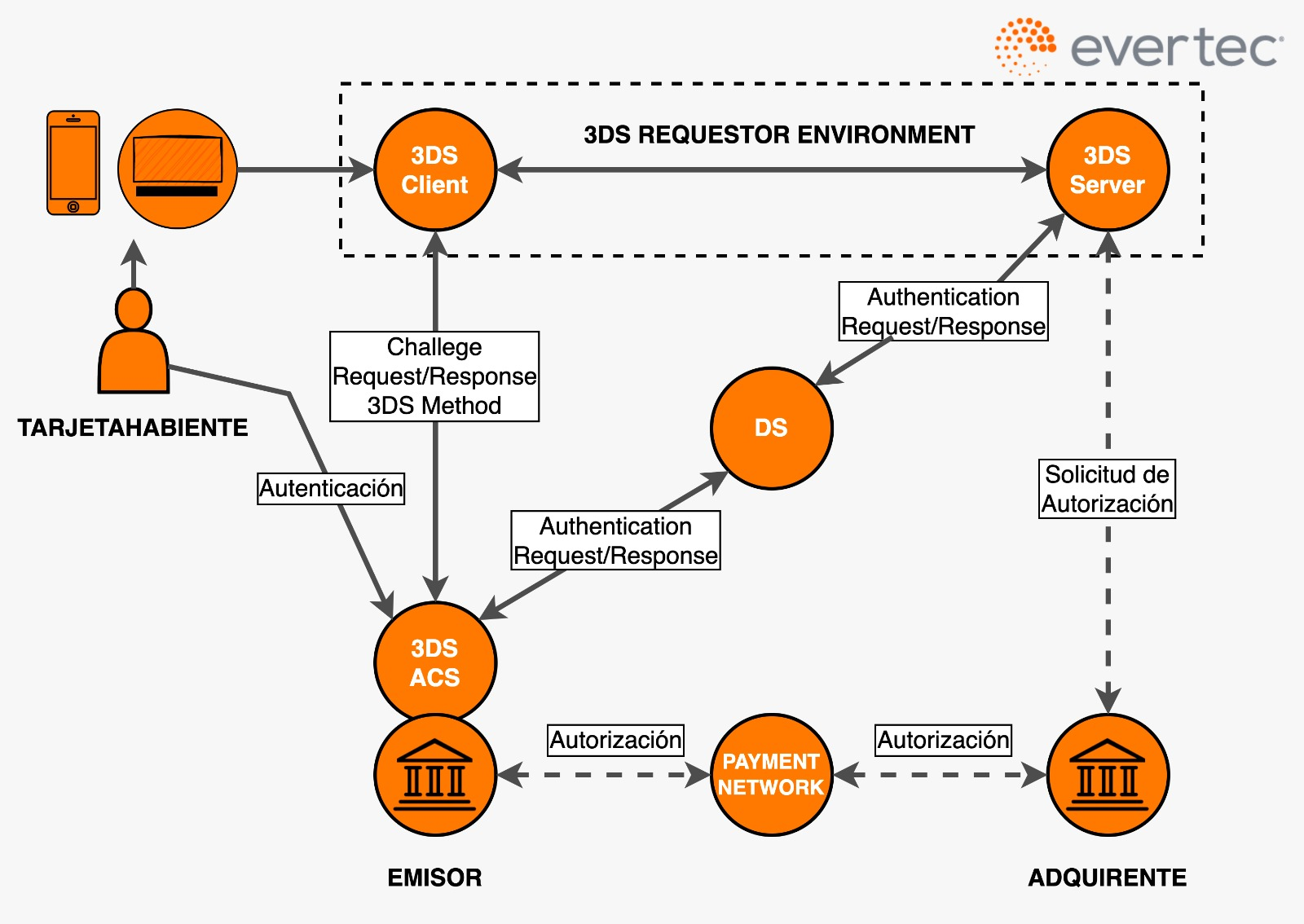

Challenge Flow

We invite you to explore our detailed API Section, where you’ll find all the technical information needed to quickly and securely integrate the 3DS Server Placetopay service into your environment.

This section is especially designed for developers and technical teams looking to make the most of Evertec Placetopay’s capabilities.

The information in this document is designed to be useful and understandable for both developers and merchants interested in integrating with the service.